The I- from IAA, the name of the annual German motor show, is synonymous with international. This year, the event is based on this principle as never before: Half of the companies present next week at the Internationale Automobil-Ausstellung in Munich will be foreign, 41% of the exhibitors coming from Asia. The number of Chinese automakers in attendance – including electric car makers BYD, Nio and Xpeng – will more than double from two years ago.

The fact that Germany is hosting its least German car show illustrates the lightning speed at which China has emerged as an automotive exporter. In addition to taking up more space in exhibition centers, the country’s automakers are capturing more of the attention of executives from Volkswagen, Mercedes-Benz and BMW, whose businesses are heavily dependent on the two economic powerhouses that seem increasingly more shaky.

Chinese automakers have launched electric vehicles at a blistering pace and are expanding overseas as a fierce price war rages at home. The Germans, meanwhile, are being forced to speed up development as software problems have delayed key new designs. Inflationary pressures, shortages of skilled workers and high energy prices across Europe add to their structural challenges.

While Chinese automakers lag far behind foreigners selling gas-powered cars, government subsidies and the country’s growing ranks of coders have helped them get ahead of the latest electric and digital technologies. They also benefit from lower production costs and a top-notch battery supply chain.

BYD, which overtook VW this year as China’s top-selling auto brand, is showcasing cars at the IAA including the Seal U sport utility vehicle, its sixth model introduced to the European market in less than a year. Avatr, the premium EV company owned by state-owned Changan Auto and CATL’s largest EV battery producer, will unbox the 12 sedan, its first model launched outside of China. MG, the British brand now owned by the Chinese group SAIC, plans to present its two-seater electric roadster, the Cyberster.

The Germans will respond with EVs, including VW’s ID.7 sedan, unveiled at the Shanghai Motor Show earlier this year, and equipped with an augmented reality screen that broadcasts information into the driver’s field of vision and whose starting price is around 57,000 euros. VW, BMW and Mercedes are bringing other electric cars to Munich, but their next-generation vehicles won’t be available until the middle of the decade. BMW will unveil a prototype of its “Neue Klasse” EV platform, which should be the basis of models marketed around 2025.

Despite all the strides they are making overseas, several Chinese electric vehicle start-ups are struggling financially due to the slowing economy and intensifying price war at home. origin. They also lack the distribution and marketing infrastructure that European incumbents have built up over decades, which could complicate their commercial offensive in the region.

But the Germans don’t just compete with the Chinese: many of them are collaborating with their competitors to gain access to new technologies and consumers in the world’s largest car market. In July, VW unveiled plans to invest $700 million in Xpeng, the fourth automaker it has partnered with in China. Mercedes is cooperating with BAIC, while BMW is leveraging technology from Great Wall for the new electric Mini Cooper.

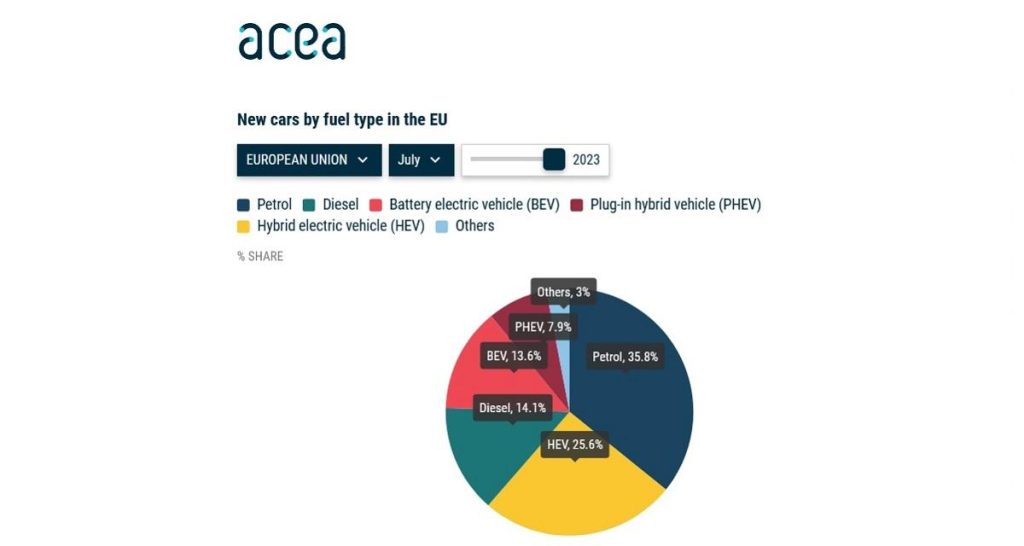

European automakers have not been idle, but time is running out as the electric vehicle market takes off. The good news is that the pressure to increase production applies to everyone, including the Chinese…